08 September 2025

Investor sentiment remains broadly stable in September, according to the latest CFA Italy Radiocor Financial Business Survey, conducted between 19 and 31 August 2025 by CFA Society Italy in collaboration with Il Sole 24 Ore Radiocor. While overall perceptions of the economic environment have not changed dramatically, a slight uptick in negative views suggests a cautious climate heading into the autumn months.

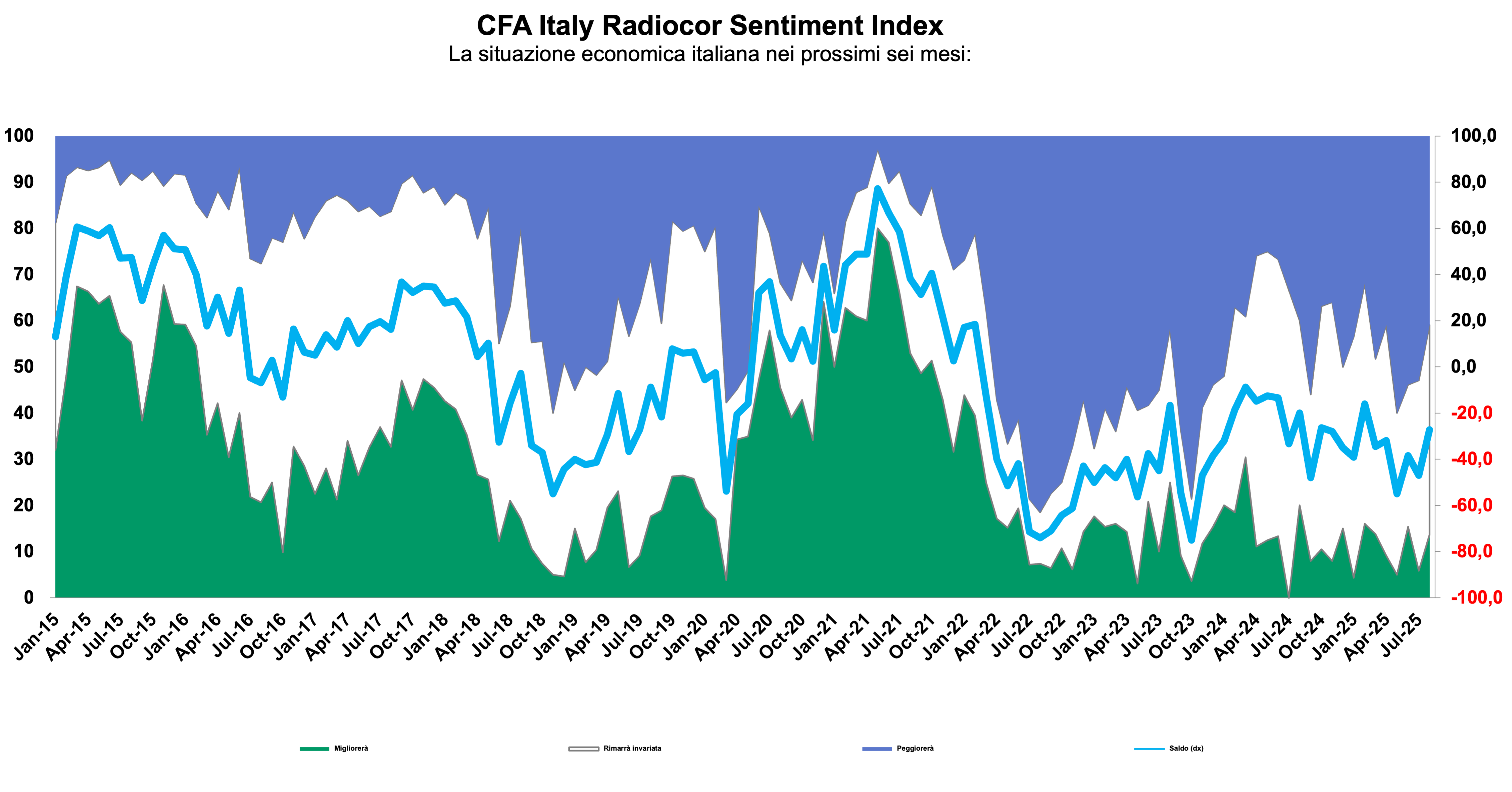

The CFA Italy Radiocor Sentiment Index - which reflects the difference between analysts expecting an improvement versus those anticipating a deterioration in Italy’s economy over the next six months - fell to -33.3 in September, down from -27.2 in August. Although the reading is still negative, the change is modest, confirming a scenario of relative stability, with 53.3% of respondents expecting no major shifts in macro conditions.

Expectations for the Eurozone remain broadly in line with those for Italy, reflecting a shared view of sluggish momentum and gradual disinflation. By contrast, the outlook for the US economy has worsened, amid persistent inflationary pressures and growing concerns over fiscal sustainability.

Inflation, Rates, and Fiscal Policy

Analysts continue to anticipate declining inflation in Italy and across Europe, while remaining firm in their expectations of higher inflation in the United States, driven in part by structural factors and the potential inflationary effects of protectionist trade policies.

Despite these divergences, the survey reveals broad consensus on future interest rate cuts - both by the European Central Bank (ECB) and the US Federal Reserve (Fed) - over the coming six months. However, attention is increasingly focused on budget deficits, particularly in the US. Rising fiscal imbalances are expected to translate into higher long-term bond yields, with analysts predicting a steepening of the US yield curve as markets demand greater compensation for duration risk.

Cautious View on Equities and Currencies

In equity markets, professionals are adopting a measured stance. The strong performance of global stock indices in recent months has prompted caution, with respondents wary of stretched valuations and a potential correction should macro conditions deteriorate further.

On the foreign exchange front, expectations remain steady: the US dollar is expected to weaken, while the Japanese yen is seen appreciating against the euro, continuing its traditional role as a defensive currency in times of uncertainty.

Oil Prices and Inflation Outlook

Another notable signal comes from the commodities market. Analysts now expect a decline in oil prices, which could act as a disinflationary force—especially in Europe—and support central banks in their move toward more accommodative monetary policy.

Please find the full report and the press release (both in Italian).