06 November 2025

The latest edition of the CFA Italy Radiocor Financial Business Survey, conducted by CFA Society Italy in collaboration with Il Sole 24 Ore Radiocor, signals a slight deterioration in expectations for Italy’s short-term economic trajectory, while overall global macroeconomic conditions remain broadly stable.

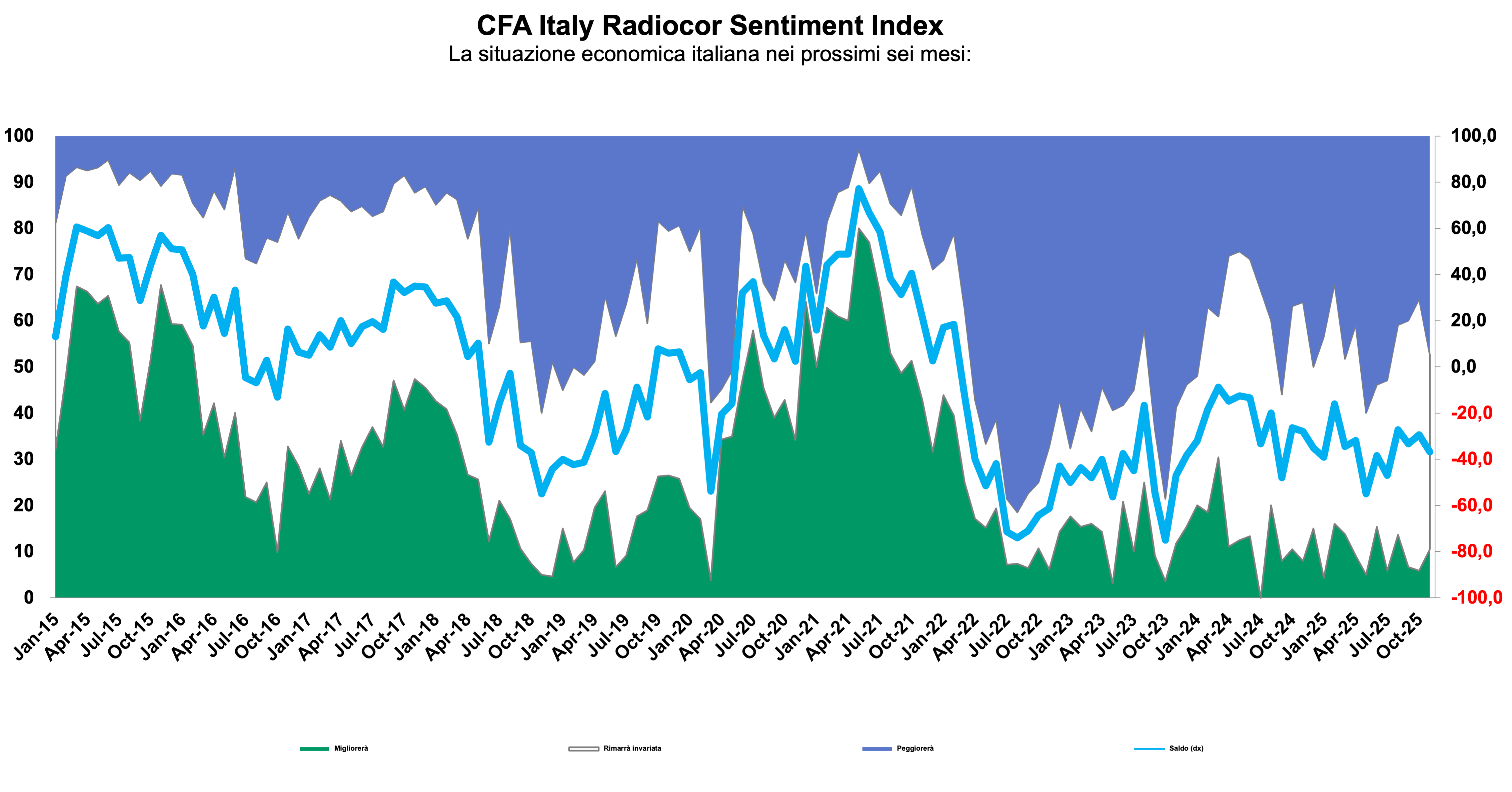

According to the survey, carried out between 20 and 30 October 2025, the CFA Italy Radiocor Sentiment Index declined by 7.4 points to -36.8. While the share of analysts expecting an improvement in Italy’s macroeconomic situation rose to 10.5% (+4.6 points), the majority now expects stability (42.1%, down 16.7 points) and a growing share foresees a deterioration (47.4%, +12.1 points).

Expectations for the Eurozone remain closely aligned with those for Italy. However, sentiment toward the US economy has worsened slightly, with concerns tied to labor market weakness and the recent government shutdown, which overshadowed late-month progress on trade discussions with China.

On inflation, the pricing outlook in Italy and Europe appears to be fading as a major concern among financial professionals. The US, by contrast, continues to register stronger inflation expectations.

Looking ahead, there is broad consensus around potential rate cuts, especially from the Federal Reserve. Analysts note that despite elevated inflation expectations, weakening macro conditions and rising fiscal spending in the US support the case for monetary easing. However, concerns about long-term government borrowing costs remain, with respondents expecting a steepening of the yield curve driven by public deficit financing needs.

On equity markets, analysts remain cautious following recent highs, although sentiment is slightly more positive toward US stocks. Currency expectations are unchanged: the dollar is forecast to weaken further, while the yen is expected to strengthen against the euro. In commodities, a reversal of recent trends is emerging, with analysts now anticipating rising oil prices—marking a shift from earlier forecasts of decline.

Gabriele Montalbetti, CFA, CIPM and Portfolio Manager at Consultinvest, noted:

“Economic slowdown and price increases linked to tariffs have yet to fully materialize, but history suggests that these effects are inevitable. Central banks have shown readiness to act, and fiscal policy in the US—and likely soon in Germany—is highly expansionary. This limits the risk of recession.”

Montalbetti also cautioned against complacency in equity markets:

“Valuations are elevated and supported by optimism around productivity and earnings gains from AI. If expectations are not met, corrections—potentially sharp ones—could occur. This risk appears underestimated and calls for caution, particularly for stocks trading at historically high multiples.”

For CFA Society Italy Members, these findings provide valuable insight into evolving market dynamics - highlighting macro, monetary, and valuation factors that should inform investment decisions and risk assessments in the months ahead.