09 January 2026

As 2026 begins, Italian financial analysts are showing signs of cautious optimism. The latest CFA Society Italy – Radiocor Financial Business Survey (here the full text), conducted between 16 and 31 December 2025 among CFA Society Italy members in collaboration with Il Sole 24 Ore Radiocor, reveals a notable improvement in expectations for the national economy, while confirming a general environment of global stability.

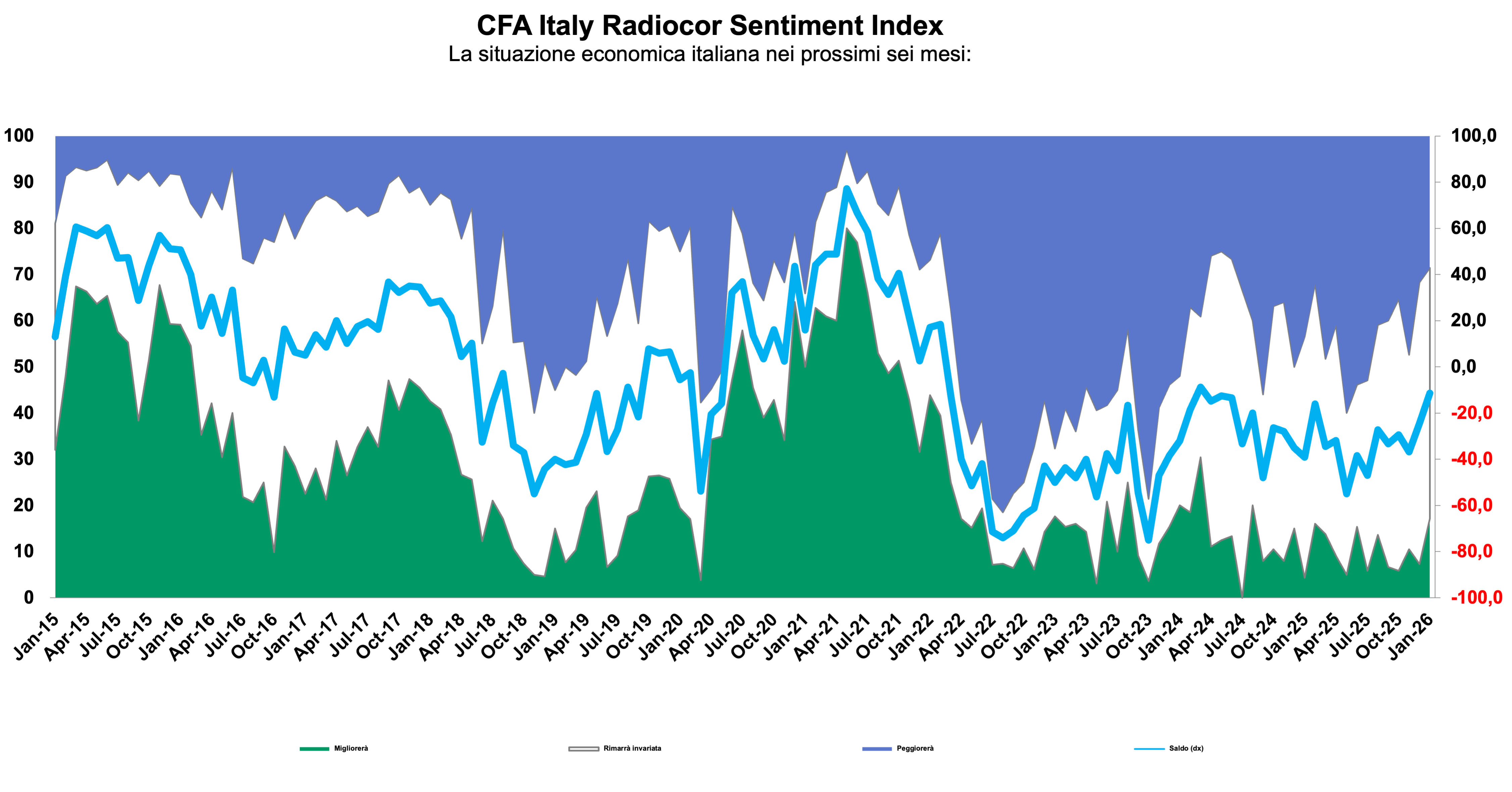

The Radiocor Sentiment Index for Italy rises to –11.4 in January, gaining 13 points over the previous month and 25.5 points since November. This is the most consistent upward trend in sentiment since mid-2025, driven largely by a sharp increase in respondents expecting stable conditions over the next six months (54.3%, down 6.7 points) and a marked reduction in pessimism (28.6%, down 3.1 points). The share of optimists also rose to 17.1%, its highest level in several months.

While sentiment remains technically negative, the direction is clear: confidence is building, supported by a combination of falling inflation expectations in Italy, ongoing economic resilience across the Eurozone, and a more positive view of the United States. In particular, inflation is seen as decelerating in Italy, holding steady in Europe, and still rising in the US—a divergence likely to influence monetary policy paths on both sides of the Atlantic.

Analysts foresee further rate cuts from the Federal Reserve, while expecting the European Central Bank to remain on hold. Long-term rate expectations remain stable or slightly upward, amid continued concerns about fiscal sustainability. On equity markets, the consensus has shifted from caution to balance, with no dominant directional bias. Commodity markets, however, may be poised for a rebound, with oil prices expected to recover after a weak 2025.

In currency markets, analysts forecast a weakening dollar and a strengthening yen, in line with anticipated policy moves by the Fed and the Bank of Japan, respectively.

As noted by Annalisa Usardi, CFA, Senior Economist at Amundi Investment Institute:

“The survey reflects a continued improvement in expectations for the Italian economy over the next six months. The index continues a positive trend that began in the summer after the sharp decline in April triggered by US tariff announcements. Despite concerns over inflation, especially in the US, the global growth outlook has proven more resilient than expected, and this has supported a re-rating of Italian assets, from equities to bonds. Factors such as narrowing spreads and upgraded sovereign ratings suggest growing international investor interest in Italy. Still, the fact that the index remains in negative territory points to awareness of persistent structural challenges—such as high debt, demographic pressure, and the fading impact of NGEU funds. The outlook may be constructive, but the macroeconomic context remains complex.”

In short, the January 2026 survey captures both the opportunities and challenges that CFA Society Italy members are called to navigate in their professional roles, reinforcing the Society’s mission to promote data-driven insights, financial literacy, and high ethical standards across the Italian investment community.

You can read the full Press Release here.