08 October 2025

In a period marked by persistent inflation dynamics and shifting interest rate expectations, the October 2025 edition of the CFA Italy Radiocor Financial Business Survey confirms a broad sense of macroeconomic stability - tempered by a rising undercurrent of caution. The survey, conducted between 19 and 30 September by CFA Society Italy in collaboration with Il Sole 24 Ore Radiocor, captures the voices of investment professionals at a moment of increasing prudence.

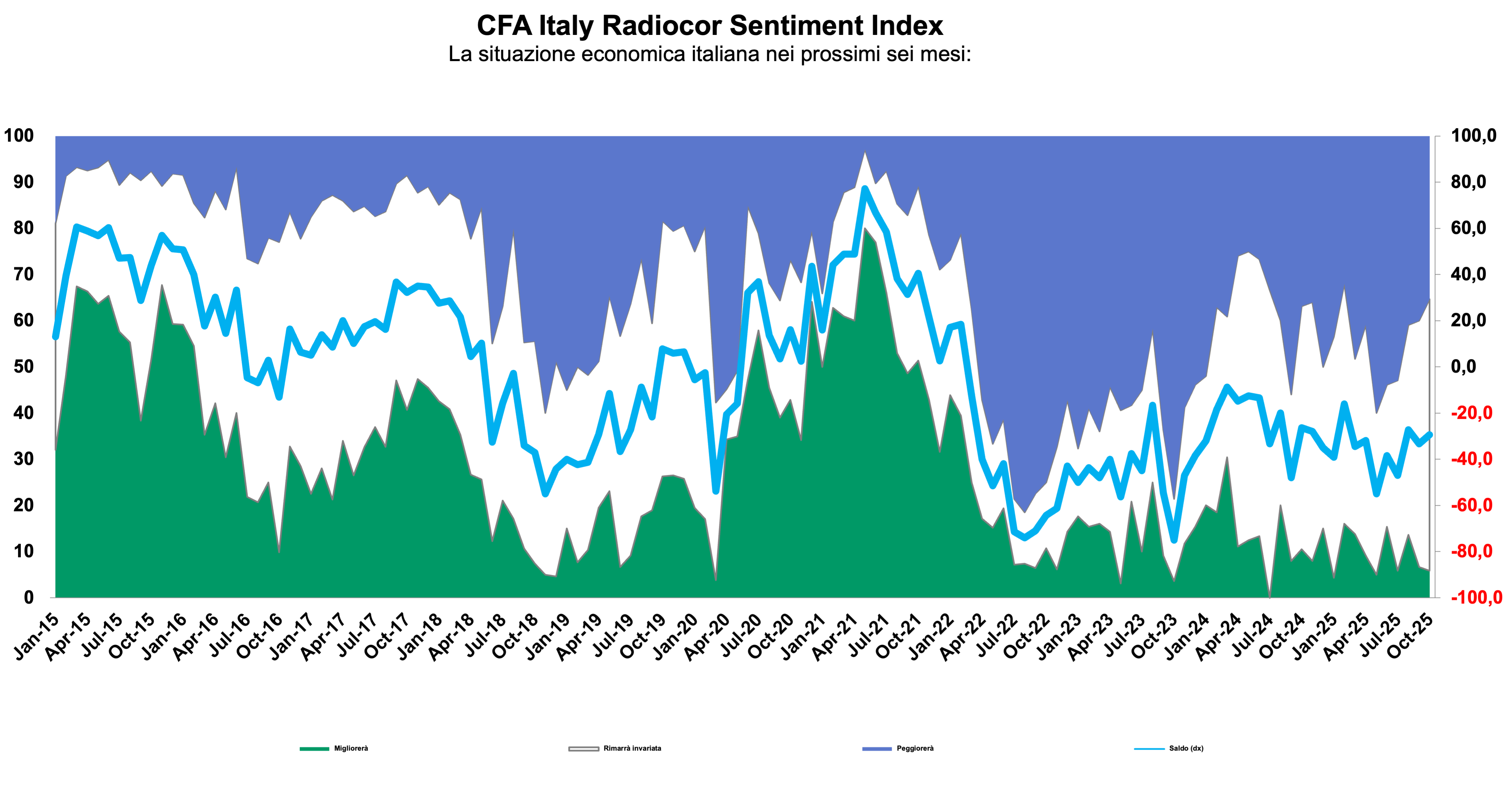

For Italy, expectations for the next six months remain virtually unchanged compared to September: only 5.9% of respondents foresee an improvement in macroeconomic conditions (a slight drop from the previous month), while the majority (58.8%) expect the status quo to continue. The percentage of pessimists declined to 35.3%. The resulting CFA Italy Radiocor Sentiment Index stands at -29.4, improving by nearly four points from the September reading, but still firmly in negative territory.

Sentiment toward the Eurozone remains broadly aligned with that for Italy. However, a glimmer of optimism is seen in the United States: while the macroeconomic outlook remains cautious, the survey highlights a modest rebound in expectations compared to previous months.

Inflation forecasts diverge by region. Italian and European inflation are expected to continue slowing, while nearly 70% of respondents anticipate a resurgence of inflationary pressures in the US - likely tied to supply constraints and geopolitical uncertainty.

In terms of monetary policy, consensus persists: financial professionals continue to anticipate rate cuts by the Federal Reserve over the next six months, despite sustained inflation. In Europe, the outlook is more conservative. Analysts expect short-term rate cuts to be limited, with long-term yields likely to remain broadly stable given the ECB’s recent accommodative stance.

Equity market sentiment remains cautious in the aftermath of recent market highs, although analysts are less pessimistic than in prior surveys. In currency markets, forecasts remain steady: continued weakening of the US dollar and appreciation of the yen against the euro.

Oil prices are now expected to remain relatively stable - marking a shift from earlier expectations of price declines. This could help contain inflation in Europe, while limiting the upside risk for global energy costs.

As macroeconomic uncertainty persists, the October survey confirms a growing need for vigilance. While no sharp corrections are expected, financial professionals appear increasingly focused on balancing stability with downside risk management—signalling a more measured approach to navigating the months ahead.

Please find the full report and the press release (both in Italian).