02 October 2024

The outlook on Italy's domestic economy among certified CFA professional investors remains negative but shows signs of improvement. The survey, conducted by CFA Society Italy in collaboration with Il Sole 24 Ore Radiocor between September 19 and 30, 2024, highlights this trend.

Most of the investors surveyed (around 70%) believe that the current Italian macroeconomic situation is stable. The U.S. macroeconomic landscape, considered particularly solid, was viewed favorably by about 80% of participants.

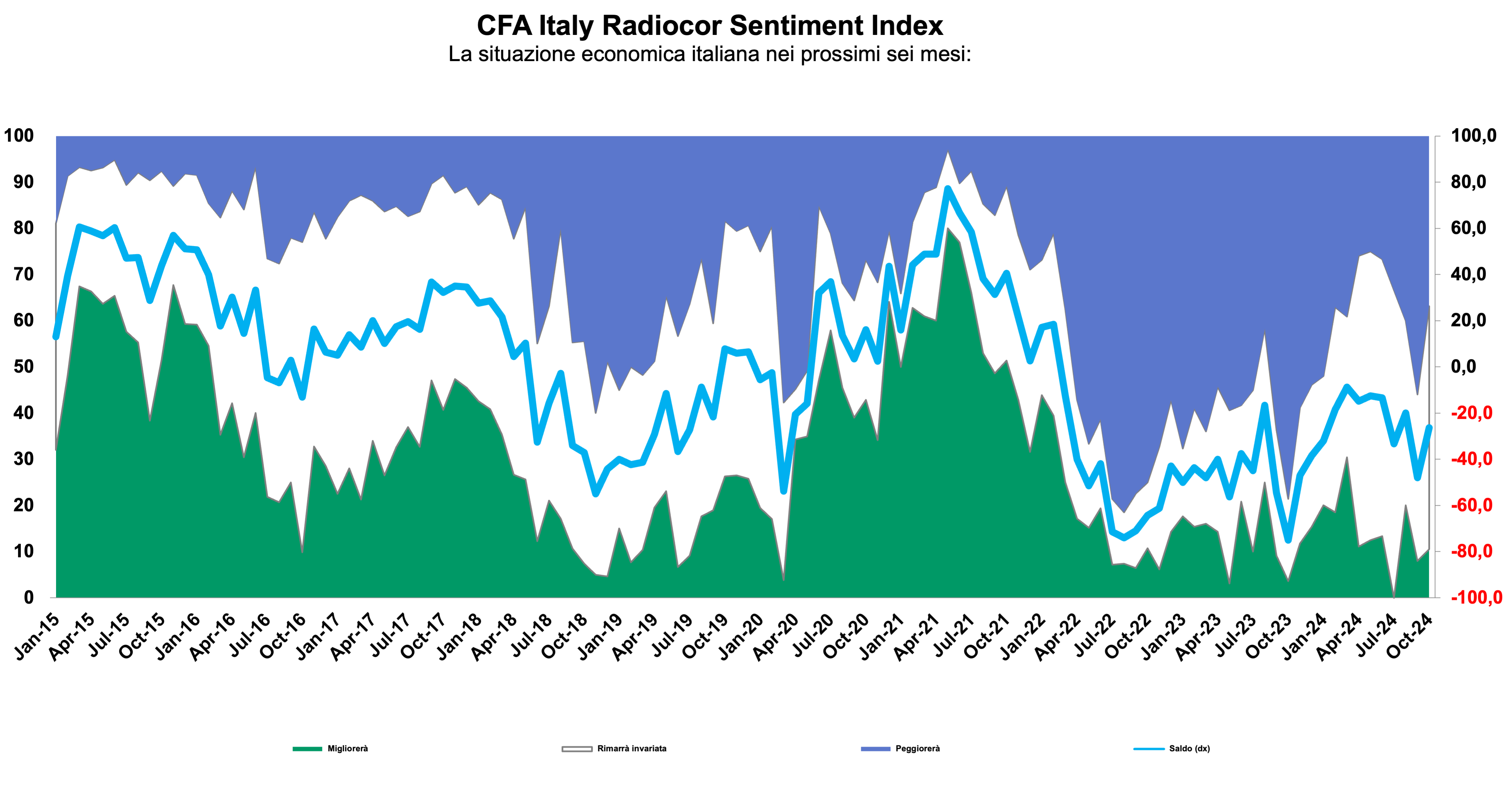

Regarding expectations for the next six months, 10.5% of respondents foresee an improvement in macroeconomic conditions (up 2.5 points from the previous month), 52.6% expect stability (up 16.6 points from the last survey), while 36.8% anticipate a deterioration (down 19.2 points from the previous month).

Although still negative, the summary indicator shows a recovery: the difference between optimists and pessimists regarding the Italian economy is -26.3, representing the "CFA Society Italy – Radiocor Sentiment Index" for October 2024, an increase of 21.7 points compared to early September.

Expectations for the Eurozone over the next six months have also improved, while a gradual decline is anticipated for the U.S. from current levels. Inflation is generally expected to decrease in both major economic regions, and there is a growing consensus on short-term interest rate reductions, in line with the easing of monetary policies announced by the Fed and ECB. However, the outlook for long-term interest rates is more uncertain, with 40% to 60% of respondents (depending on the region) expecting rates to remain unchanged on longer-term yield curves.

The outlook for major stock indices has improved compared to previous months, with a further rise since the last survey. On currencies, the U.S. dollar is expected to remain stable against the euro, while the yen is anticipated to continue strengthening against the single currency. Finally, oil prices are expected to decline, though less sharply than predicted in the previous month.

Gabriele Montalbetti, CFA, CIPM, Portfolio Manager at Consultinvest (*), commented:

“Global economic growth is currently in a cyclical slowdown, though the likelihood of a recession remains low. Consumption is slowing, but still at good levels, supported by a strong labor market. However, manufacturing expectations in both the U.S. and Europe have been signaling contraction for many months, though this has been limited to certain sectors, particularly the automotive industry. The drop in oil prices is another factor contributing to the decline in inflation, which is now close to central banks' target levels.

This has allowed both the ECB and the Fed to begin a rate-cutting cycle, but market expectations seem overly optimistic, as was the case at the end of 2023, both in terms of the number and timing of cuts. Recent decisions by the Chinese government to implement a significant stimulus plan to revive the economy have renewed interest in a market that has been largely neglected by international investors for many months. However, it is too early to determine if these measures will resolve some of the structural issues facing China.

Beyond economic considerations, the global outlook is still marked by considerable geopolitical uncertainty, particularly in Israel. The greatest risk is the potential expansion of the conflict to involve Iran or other major countries, which could have unpredictable consequences for the stability of the region and oil prices. The upcoming U.S. elections also add uncertainty, though not necessarily in terms of radical changes in economic policy, especially in case of 'cohabitation' between President and Congress of different colours.”

(*) Disclaimer

“The Comment of the Month” includes, from time to time, the analysis of a professional from the Italian financial sector who is a member of CFA Society Italy. The forecasts mentioned in it are those of the interviewee and do not necessarily reflect the views of CFA Society Italy or Consultinvest.