07 November 2024

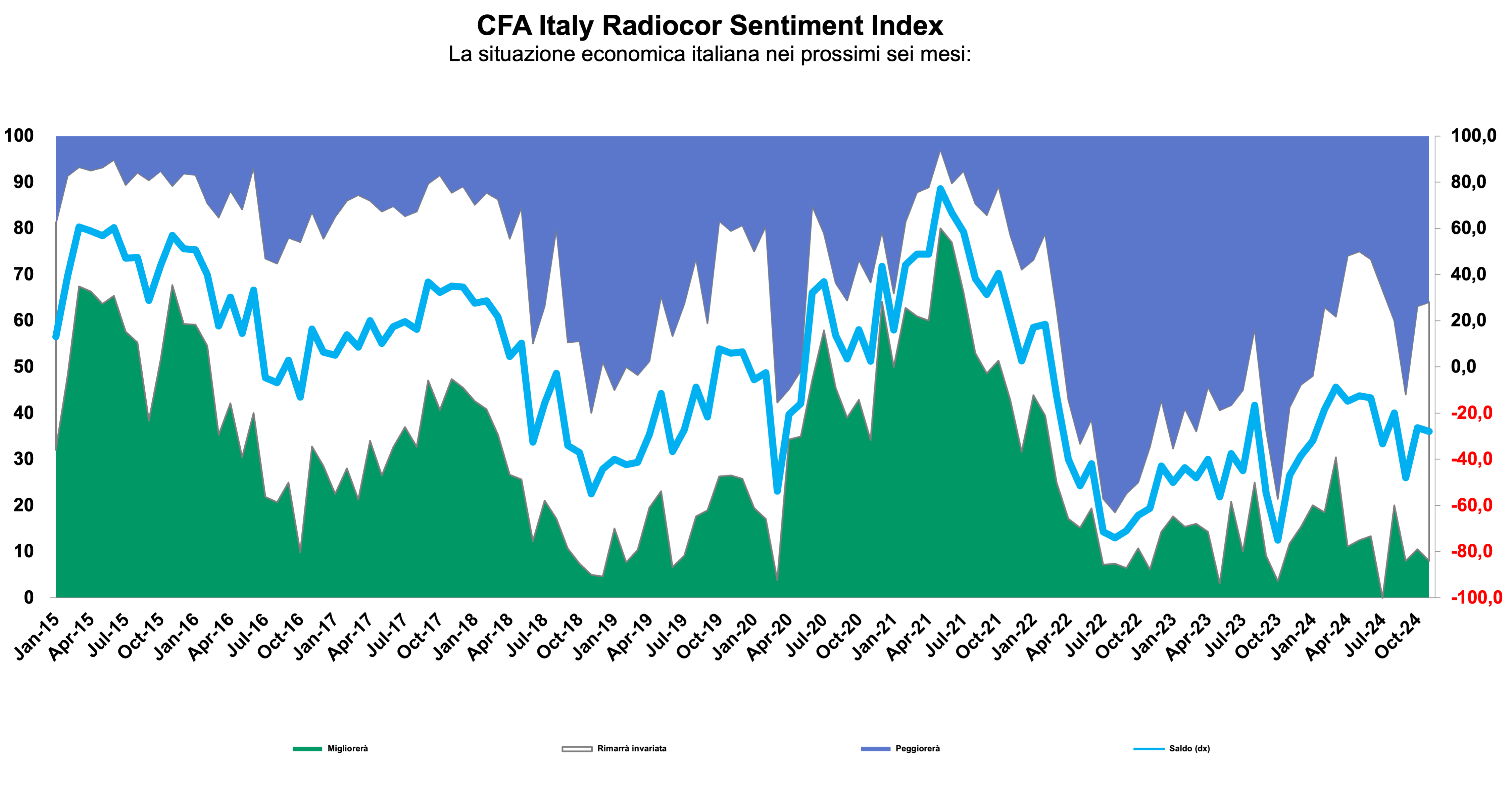

Italian professional investors certified by CFA® continue to hold steady expectations for the domestic economy: the “Sentiment Index” stands at -28 points (a slight decline of -1.7 points from the previous survey).

Milan, November 4, 2024

The survey, conducted by CFA Society Italy in collaboration with Il Sole 24 Ore Radiocor, was carried out among its members between October 21 and October 31, 2024. Most investors surveyed (60%) consider Italy’s current macroeconomic situation stable. Confidence remains high in the resilience of the U.S. economic cycle, with 72% of respondents expressing this view.

Looking ahead over the next six months, 8% of respondents expect an improvement in macroeconomic conditions (-2.5 points compared to last month), 56% anticipate stable conditions (+3.4 points from the last survey), while 36% foresee a deterioration (-0.8 points from the previous month). The index remains in negative territory with little change from the previous survey: the difference between optimistic and pessimistic outlooks on Italy’s economic prospects stands at -28, i.e., the “CFA Society Italy - Radiocor Sentiment Index” for November 2024 (-1.7 points from October).

Expectations for the Eurozone align with those for the Italian economy, while the U.S. outlook suggests weakening, albeit with some improvement from the previous survey.

Inflation and Interest Rates

Inflation is generally expected to decline over the next six months across both major economic regions, though a trend toward stability in this variable is beginning to emerge after a year of decreases. The consensus on short-term rate reductions remains nearly unanimous, whereas expectations for long-term rates are more uncertain. In Europe, 60% of respondents anticipate unchanged long-term rates, while 40% predict an increase in long-term yields for the U.S., possibly reflecting anticipated fiscal policies that could impact American public debt growth.

Equity Indices and Currency Exchange

Expectations remain cautious for major equity indices following record highs in recent months. The EUR/USD exchange rate is expected to remain stable, with a continued expectation for the Japanese yen to appreciate against the euro.

Commodities

Oil prices are anticipated to rise after months of negative outlook on this front.