07 May 2025

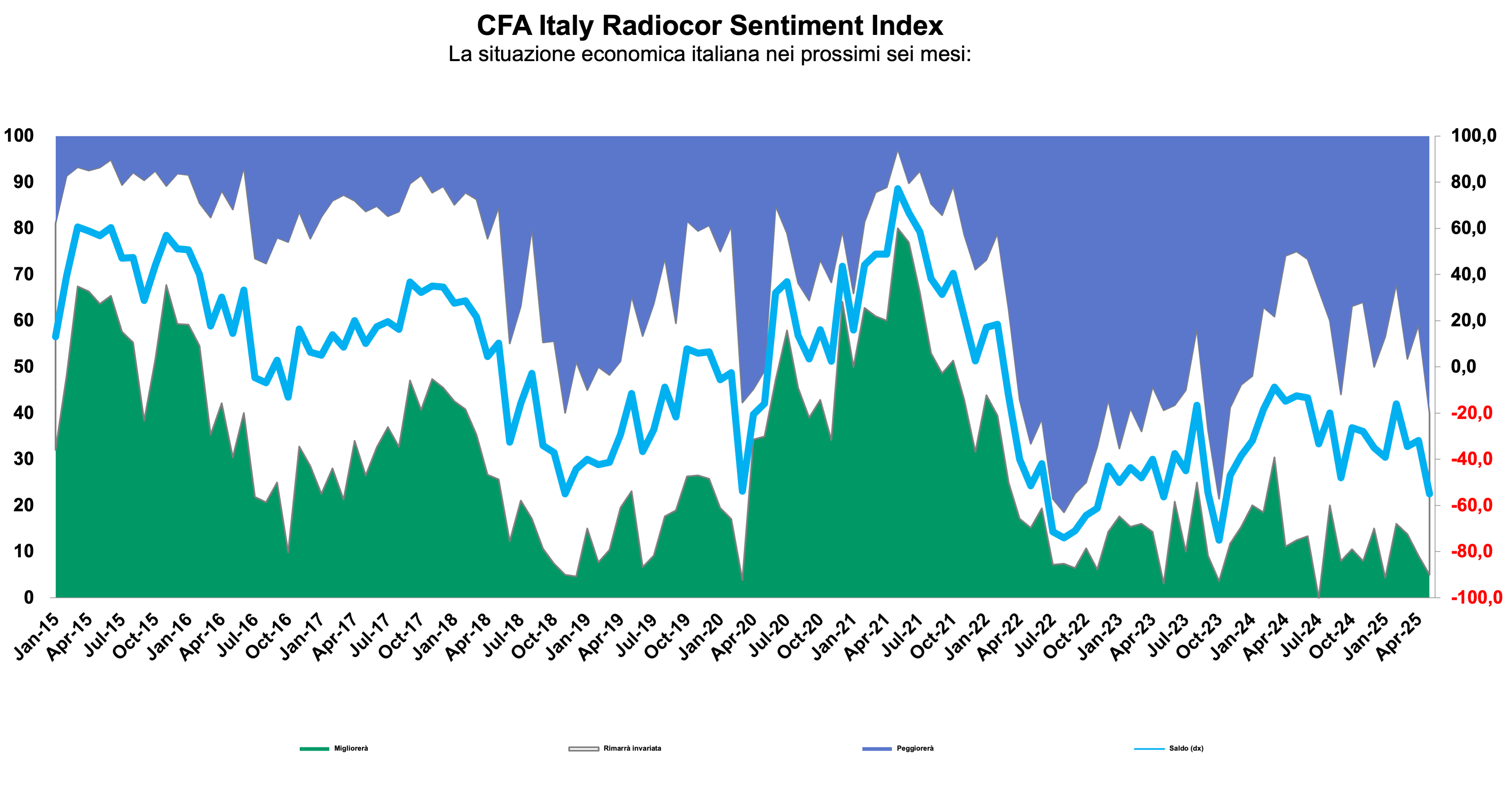

Investor confidence among Italian financial professionals has plummeted, with the CFA Italy Radiocor Sentiment Index falling to -55 points in May — a drop of over 23 points from the previous month and one of the lowest readings in recent years. The findings, based on a survey conducted by CFA Society Italy in partnership with Il Sole 24 Ore Radiocor between 17 and 30 April, capture a sharp deterioration in economic sentiment driven largely by fears of a global slowdown.

The survey reveals that sweeping tariff announcements by the Trump administration — widely perceived as a protectionist pivot — have triggered major concerns among analysts. Only 5% of respondents now expect improvements in Italy’s macroeconomic outlook over the next six months, while 60% foresee deterioration, up 19 points from April. The collapse in optimism has also dragged down sentiment on the European economy, with even sharper declines noted in expectations for the United States, where the sentiment index plunged to a staggering -85 points.

Inflation Fears Return, Yield Curve Steepening Expected

Analysts are also recalibrating their inflation expectations. While price stability is anticipated in Italy and the Eurozone, many now warn of a potential inflation surge in the U.S., driven by supply-side shocks tied to new trade barriers. This, combined with slower growth forecasts, has led to predictions of imminent interest rate cuts by central banks.

However, expectations for longer-term bond yields are less clear, due to the possibility of inflation remaining above central bank targets. As a result, many expect yield curves in both Europe and the U.S. to steepen in the coming months.

Markets on Alert: Equities, Currencies, and Commodities in Focus

U.S. equities are seen as more vulnerable to further declines, while European and Italian markets are expected to be relatively more resilient. On the currency front, analysts forecast a weakening U.S. dollar and a strengthening yen — reflecting deepening investor concerns about the U.S. economic and inflation outlook.

Oil prices are projected to trend lower, in line with expectations of reduced global demand amid a broader economic slowdown.

Annalisa Usardi, CFA, Senior Economist and Head of Advanced Economy Modelling at Amundi Investment Institute, commented:

“The deterioration of the Sentiment Index and its subcomponents in April reflects the shock triggered by the announcements made on what has been dubbed ‘Liberation Day’. While a U.S. administration focused on deploying protectionist measures as economic and geopolitical tools was already anticipated, the scale and scope of the measures announced—alongside temporary suspensions, ongoing negotiation announcements, and countermeasures by affected countries—have severely clouded visibility over future developments and exponentially increased uncertainty regarding final impacts. It is therefore unsurprising to see such a strong market reaction, which has led to a major reassessment of the new U.S. administration after an initial ‘honeymoon phase’. The greatest uncertainties currently centre on the growth-inflation mix, which now appears less favourable than initially expected, especially from the Federal Reserve’s perspective, and on the potential implications of these measures for U.S. public finances.”

For further information, please read the press release and full report (Italian only).